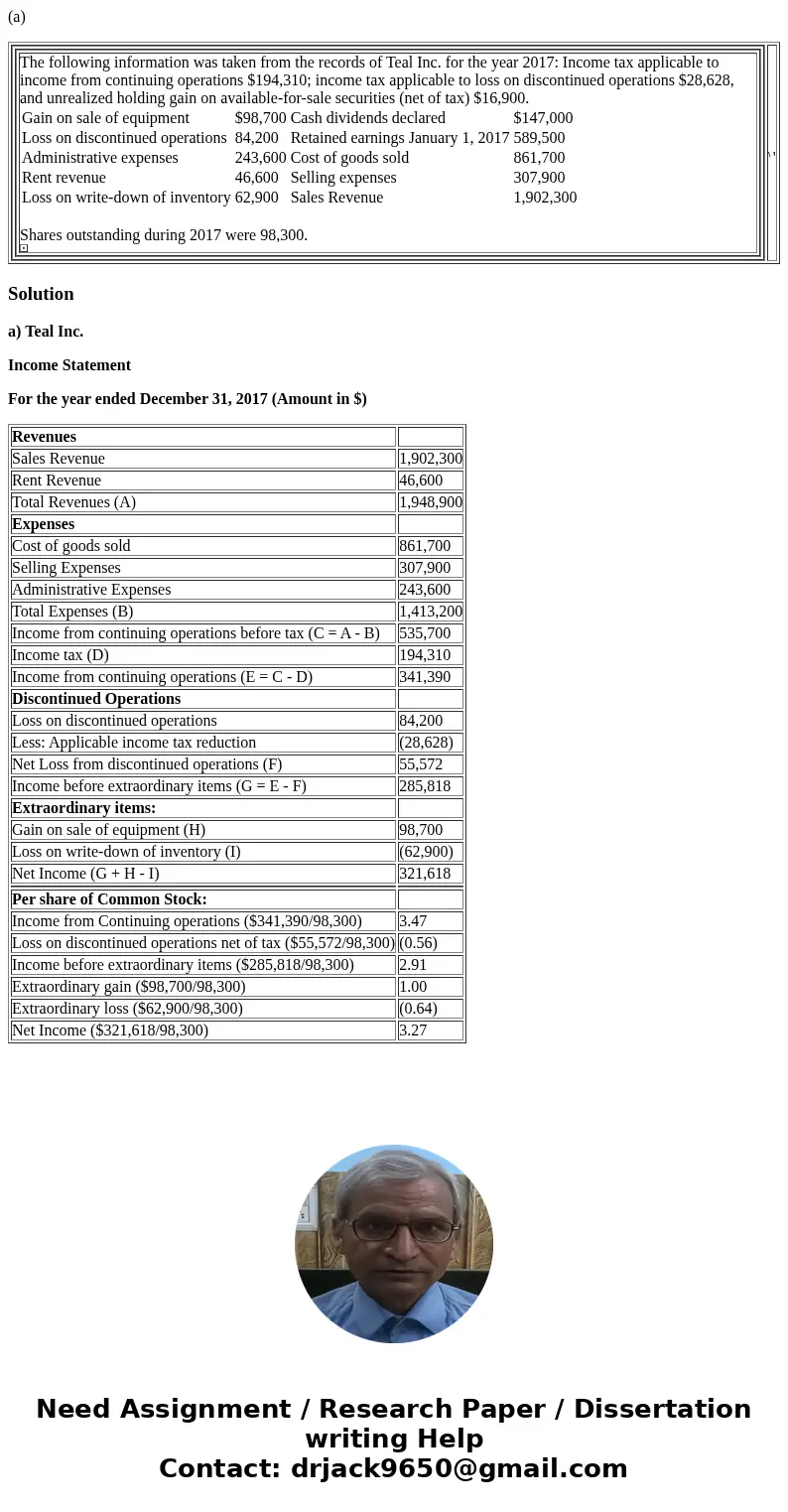

a The following information was taken from the records of Te

(a)

|

Solution

a) Teal Inc.

Income Statement

For the year ended December 31, 2017 (Amount in $)

| Revenues | |

| Sales Revenue | 1,902,300 |

| Rent Revenue | 46,600 |

| Total Revenues (A) | 1,948,900 |

| Expenses | |

| Cost of goods sold | 861,700 |

| Selling Expenses | 307,900 |

| Administrative Expenses | 243,600 |

| Total Expenses (B) | 1,413,200 |

| Income from continuing operations before tax (C = A - B) | 535,700 |

| Income tax (D) | 194,310 |

| Income from continuing operations (E = C - D) | 341,390 |

| Discontinued Operations | |

| Loss on discontinued operations | 84,200 |

| Less: Applicable income tax reduction | (28,628) |

| Net Loss from discontinued operations (F) | 55,572 |

| Income before extraordinary items (G = E - F) | 285,818 |

| Extraordinary items: | |

| Gain on sale of equipment (H) | 98,700 |

| Loss on write-down of inventory (I) | (62,900) |

| Net Income (G + H - I) | 321,618 |

| Per share of Common Stock: | |

| Income from Continuing operations ($341,390/98,300) | 3.47 |

| Loss on discontinued operations net of tax ($55,572/98,300) | (0.56) |

| Income before extraordinary items ($285,818/98,300) | 2.91 |

| Extraordinary gain ($98,700/98,300) | 1.00 |

| Extraordinary loss ($62,900/98,300) | (0.64) |

| Net Income ($321,618/98,300) | 3.27 |

Homework Sourse

Homework Sourse